The transition to commercial electric vehicles is underway, but it’s costly. What can be done? We explored some of the available solutions with global asset finance firm DLL.

Road transport operators worldwide are committed to decarbonisation, as revealed by IRU’s new survey, but high vehicle costs remain a significant obstacle.

Nick Antoniou, Global Head of eMobility Finance at DLL, an IRU strategic partner, walked us through some of the available solutions, such as flexible leasing.

What is the biggest decarbonisation challenge?

Today, businesses of all sizes are recognising the importance of adopting more sustainable practices. However, the commercial road transport sector continues to face several hurdles, particularly with electric vehicles (EVs).

The upfront cost of battery-electric vehicles is typically higher than that of traditional vehicles. However, the total cost of ownership (TCO) of an EV over its lifespan can be lower, thanks to reduced maintenance requirements and lower energy costs.

To manage the TCO, leasing solutions have become increasingly popular. They allow companies to spread the cost over time and access the latest technology. Technological advancements, increased adoption of EVs, and economies of scale could also reduce the TCO over time.

Another major challenge facing the adoption of EVs is the limited availability of charging infrastructure. Unlike gas stations, charging points are still relatively limited and not always available for commercial use. Companies often need to install their own charging infrastructure or rely on a limited number of public charging stations. Many companies, such as UPS, have decided to build micro-hubs near city centres to circumvent this important limitation.

The range reliability of EVs and their ability to maintain their performance in harsh weather conditions are other challenges.

Are there regional differences?

The eMobility transition has progressed significantly within the EU transport and logistics industry.

A market spotlight by the International Council on Clean Transportation revealed buoyant demand for zero-emission heavy-duty vehicles in the three largest EU markets (Germany, France and Italy). Germany is particularly active, representing 40% of the EU’s total zero-emission heavy-duty vehicle sales in Q1 2024, despite a 9% contraction in the market overall.

Sales of light and medium reduced emission vehicles also increased over the same period and made up more than 8% of EU sales, compared to 6% at the end of 2023. Again, Germany led the charge, accounting for 68% of commercial EV sales in Q2 2023. Conversely, the French market contracted from 38% in 2023 to 11% in Q1 2024.

In addition, an analysis of European mobility finance, compiled by McKinsey & Company, suggests that full-service leasing, new car subscriptions, and financing for used cars are all promising businesses with the potential to create around EUR 25 billion of new annual revenue for mobility-finance providers by 2030.

In the US, a report compiled by TRC Companies, a global environmental consulting and energy firm, highlights unprecedented levels of public and private investment in battery-electric vehicles over the past five years.

How are you helping the industry decarbonise?

Through our innovative financial solutions, we support the full value chain and different niche sectors, including micro mobility vehicles, light and heavy-duty EVs, charging infrastructure, waste collection fleets, electric equipment for airports and ground operations, sustainable public transport, intralogistics, and last-mile delivery fleets, among others.

We have the experience and expertise to support our partners and customers in their transition. Tailored financing packages cover investments in new vehicles as well as associated costs like charging infrastructure and maintenance.

Our sophisticated, international view on asset costs, life cycles and associated residual values means we can offer flexible, up-to-date solutions, including global master lease agreements spanning multiple countries, regions, brands and asset types.

We recognise that flexibility remains crucial for all financing options. As more sustainable transport and logistics solutions rapidly evolve, businesses need continued financial support to invest in new solutions.

Any success examples to share?

Online supermarket Picnic turned to DLL in 2019 to expand its German operations and finance its large fleet of electric delivery vehicles. We helped Picnic free up the capital that would otherwise be tied up in its fleet, allowing it to invest in other business priorities while continuing to deliver groceries efficiently.

We have also partnered with electric commercial vehicle manufacturers, such as E-Trucks Europe. These financing partnerships facilitate the transition from diesel to electric trucks. This will expand as we partner with more manufacturers globally.

What trends are on the horizon?

The acceleration to eMobility is integral to future growth in the logistics sector. The market is increasingly interested in investing in commercial electric vehicle adoption, driven by both environmental concerns and long-term cost savings. Both logistics and eMobility solutions are expected to positively impact the environmental and social footprint of supply chains and logistics. Enhancing these aspects creates value for customers, stakeholders and society by reducing greenhouse gas emissions and improving public health.

As eMobility becomes more prevalent and impactful, many countries are implementing regulations and subsidies to support the adoption of EVs. These programmes can help overcome some of the challenges and barriers facing EVs, such as the high upfront costs, infrastructure shortfalls, and industry acceptance.

What specific incentives or policies are most effective?

There are various subsidies and incentives available to encourage and support the adoption of EVs for last-mile delivery. These programmes can help fleet owners overcome the initial barriers and achieve a reasonable TCO.

Many countries recognise the importance of promoting eMobility to reduce greenhouse gas emissions and improve air quality. They have implemented various subsidies and incentives to encourage and support the adoption of EVs in the transport sector. These programmes can take different forms, such as:

- Subsidies: Direct payments or grants from governments or organisations to reduce the purchase price or operational cost of EVs

- Tax credits: Reductions or tax refunds related to the purchase or use of EVs

- Tax exemptions: Waivers or tax reductions or fees normally applied to conventional vehicles, such as registration fees, road taxes, or congestion charges

- Rebates: Partial refunds of the purchase price or operational costs of EVs from governments or organisations

- Discounts: Reduced prices or fees for EVs or related services, such as electricity prices, parking fees, or toll charges

- Bonus payments: Additional payments or rewards for purchasing or using EVs or related services, such as free charging stations, access to bus lanes, or loyalty programmes

The availability and amount of these subsidies and incentives vary depending on the country and region, as well as the type and size of EVs. Some countries have national programmes, while others have regional or local ones. Some countries have general programmes that apply to all EVs, while others target certain segments or sectors.

New programmes and market opportunities continue to emerge. Fleet owners must stay up to date and informed about the regulations and subsidies in their regions, as well as how best to benefit from them.

How do you measure and track progress?

For DLL, the focal points for sustainability are climate, biodiversity and circularity as well as diversity, equity and inclusion of our member base.

We are focused on further implementing our sustainability transition and have set Road to Paris-aligned targets for reducing emissions from our own operations. We have also created transition plans for the majority of our portfolio to lower emissions.

Our sustainability strategy prioritises activities that support DLL’s overall goal to be the transition partner for a better world through the following commercial, social and organisational ambitions to:

- Help existing partners achieve their sustainability ambitions by aligning our strategic initiatives and solutions

- Onboard new partners that focus on our three key transition areas: energy, food and agriculture, and circularity

- Invest in new opportunities, including adjacent propositions, channels and markets, and innovations in the three transition areas

- Build a diverse and inclusive workplace that enables members to achieve their full potential

- Comply with ESG regulations and commitments, and adhere to high ESG standards in the way we do and run our business

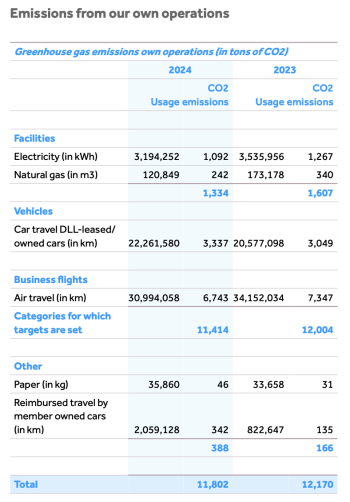

Currently, there is only one generally accepted metric to measure environmental impact: the calculation of greenhouse gas emissions. As a business, we impact the climate through:

- Our own operations, such as travel and use of electricity

- Our portfolio, which we refer to as financed emissions

In 2024, we further improved the methodology for calculating emissions from our own operations and expanded the scope to include air travel. We then submitted our data gathering, calculations and target setting to a third party for validation. It concluded that our methodology is fit-for-purpose.

More information can be found in our 2024 annual report.

Discover more decarbonisation best practices and expertise in IRU's new Green Compact Survey Report.

About DLL

DLL is a global asset finance company for equipment and technology with a managed portfolio of more than EUR 47 billion. Founded in 1969 and headquartered in Eindhoven, the Netherlands, DLL provides financial solutions within the Agriculture, Construction, Energy Transition, Food, Healthcare, Industrial, Technology, Transportation, and Workplace industries in more than 25 countries. The company partners with equipment manufacturers, dealers, and distributors to enable easier access to equipment, technology, and software, to support business growth.

DLL is committed to a more sustainable future for the environment and the communities in which it operates. Combining customer focus and industry knowledge, DLL provides financial solutions for the complete asset life cycle, including commercial finance, retail finance and used equipment finance. DLL is a wholly owned subsidiary of Rabobank Group.

To learn more about DLL, visit www.dllgroup.com.