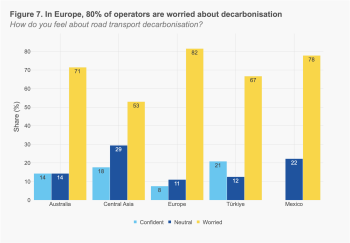

- Over 70% of road transport operators worry about decarbonisation (80%+ in Europe)

- High costs, lack of infrastructure and uncertainty are top barriers to investment

- But over 50% do plan alternative fuel investments within five years, notably biofuels

A new IRU survey has, for the first time, assessed the current decarbonisation status and future investment plans of commercial road transport operators globally. Although operators are increasingly integrating decarbonisation into their strategies, key barriers and uncertainty are blocking progress, especially for SMEs.

IRU’s new annual Green Compact survey has found that commercial road transport operating companies are committed to decarbonisation – adopting efficiency measures and planning alternative fuel investments – but high vehicle and energy costs, limited infrastructure and complex regulation remain significant obstacles to further progress.

The new survey took the pulse on decarbonisation expectations, concerns and planned investments from road transport operators in Australia, Central Asia, Europe, Mexico and Türkiye. Reflecting the make-up of the industry, 86% of respondents were SMEs.

IRU Secretary General Umberto de Pretto said, “The road transport industry is committed to carbon neutrality, but this new landmark survey shows that most operators are struggling to reconcile regulatory and market expectations with high up-front costs and a lack of infrastructure.”

“If we don’t remove cost and infrastructure barriers in particular, alternatively fuelled vehicles will be almost impossible to buy and operate for many companies, especially the 85% of operators globally which are SMEs, putting at risk our global net-zero commitments,” he added.

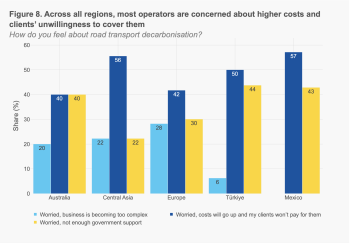

High vehicle and energy costs alone are only half the story. Most operators report a lack of willingness from their clients to cover additional capital and running costs via higher transport prices (for example, 67% in Australia and 58% in Europe).

Progress is also hampered by a lack of enabling conditions. In Türkiye, 70% of operators report difficulties installing depot chargers, while half of Central Asian operators face challenges in obtaining alternatively fuelled trucks. In Europe, 60% cite a lack of public recharging infrastructure.

Reflecting these practical difficulties, 90% of operators still plan to buy new diesel vehicles in the future. On alternatives, more report investment plans in biofuels than any other alternative fuel, with electric vehicles ranking second in terms of investment priority.

“This report demonstrates something that we have been saying for a long time: without the right enabling conditions, millions of road transport operators around the world will not be able to buy or run alternatively fuelled vehicles,” said Umberto de Pretto.

“Governments need to act now in providing investment incentives, lowering risk and advancing infrastructure for operators to make the best long-term investment decisions to decarbonise effectively while keeping vital road transport services running,” he added.

The survey also assessed driver, vehicle and logistics network efficiencies and collective passenger transport status. The full 90-page report of survey results includes sections on current regulatory approaches and outlines enabling conditions for the sector.