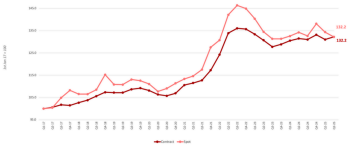

The Upply x Ti x IRU study on European road freight rates has found that the contract and spot rate indexes converged at 132.2 in Q2 2025. The benchmark spot rate index declined by 2.2 points quarter on quarter (q-o-q), while the contract rate index inched up by 1.2 points over the same period. Year on year (y-o-y), spot rates are down by 2.0 points, whereas contract rates have risen slightly by 0.7 points. Spot rates are now at their lowest level since Q4 2023.

- The Q2 2025 European Road Freight Contract Rate Benchmark Index rose to 132.2, 1.2 points higher than in Q1 2025 and 0.7 points higher than in Q2 2024.

- The Q2 2025 European Road Freight Spot Rate Benchmark Index fell to 132.2 points, 2.2 points lower than in Q1 2025. Spot rates were also down by 2.0 points y-o-y.

- Trade by road between major economies (Germany, France, Poland, Italy and Spain) has rebounded since the December 2024 low point. However, international tonnage exchanges between these economies are lower compared to 2024.

- There are 426,000 unfilled truck driver positions across Europe, according to IRU’s 2024 survey.

- Diesel prices were down by 6.4% compared to Q1 2025, though prices have risen in recent weeks following the Israel-Iran war.

- The Road Freight Sentiment Index for Q2 stands at 8.2, indicating that respondents expect a slight increase in the next quarter.

- There is modest upward pressure on rates across Europe, as demand improves and operating costs remain relatively stable.

There has been a short-term easing in demand pressure, but some demand pressure is expected to return in the medium to long term, led by a recovery in EU retail activity. Cost pressures are also subsiding, with falls in diesel prices offsetting wage and operating cost increases. The biggest factors therefore driving the benchmark road freight index are demand-driven.

Europe’s road freight market is facing a mix of demand dynamics, coupled with an uncertain global economic environment. Modest European manufacturing gains in some countries are slightly lifting contract rates. Manufacturing is showing signs of stabilisation. Eurozone factory output began expanding in June, with new orders stabilising and the HCOB PMI rising to 49.5, the highest level since August 2022, though still just below the threshold for growth (50 points).

Spot rates have declined for the second quarter in a row. They are now at their lowest level since late 2023, reflecting softer short-term consumer demand. While grocery retail growth and food production are still growing, broader retail sentiment is weakening. This highlights a split between essential and discretionary spending. However, the slump in retail will not persist. Consumer fundamentals are improving across the board in Europe, and spending might pick up and put upward pressure on rates in the medium term.

Nonetheless, external pressures remain. Tariffs have the potential to reshape the trade landscape, with increased imports from China due to rocky US-China trade relations. If these flows increase, freight demand could rise alongside them, particularly on city-to-port lanes, putting upward pressure on rates later in the year.

Ti Head of Commercial Development Michael Clover said, “European demand appears to be recovering, particularly on the manufacturing side, while consumer demand is still quite soft. In a fairly stable cost environment, this looks set to lead to gradual contract rate increases. However, with spot rate growth drifting down, there may be opportunities to secure cheaper rates outside of contracts through the second half of the year.”

Market capacity has been expanding, with new registrations rising by more than 10% q-o-q. However, the shortage of drivers persists as a constraint on capacity. There are 426,000 unfilled truck driver jobs in Europe, according to IRU’s 2024 global truck driver shortage report.

In terms of the underlying cost drivers, Q2 2025 saw diesel prices fall by 6.4%. But they rebounded at the end of Q2 due to the Israel-Iran war. Regarding tolls, Q1 2025 saw an increase in numerous countries (except in Latvia for EURO VI articulated vehicles). Year on year, toll increases range from +1.8% in Italy to +41% in Slovakia.

IRU Senior Director for Strategy and Development Vincent Erard added, “Softening domestic demand, new US tariffs, and rising global trade volatility will test Europe’s freight ecosystem in the months ahead. Europe must reinforce its logistics foundations. Operators are responding by expanding capacity and accelerating the shift to cleaner fleets. Long-term competitiveness hinges on policy support: smarter infrastructure, streamlined cross-border access to qualified drivers, and harmonised rules, such as Spain’s newly announced weight and dimension limits for EMS vehicles, nurturing more efficient logistics. In a changing global landscape, Europe’s success will depend on foresight and operational agility.”

The Ti x Upply x IRU European Road Freight Sentiment Index fell 5.0 index points to 8.2 in Q2 2025, indicating a slight increase was expected in Q2 2025 freight rates. This is in line with the expectations suggested by the macro indicators for strengthening European demand, which should boost volumes.

Upply Chief Executive Officer Thomas Larrieu commented, "The convergence of spot and contract rates reflects a fragile balance in the European road freight market. Despite early signs of recovery, demand remains moderate, and pressure on the spot market is therefore low. At the same time, the contract market saw a slight increase in Q2, but looking at the history of the past two years, we can see that the index has remained fairly stable. Given the weakness of demand, carriers are finding it difficult to pass on the full increase in their operating costs. This is weighing on investment capacity, which could lead to difficulties in accessing capacity when a more pronounced recovery occurs.”