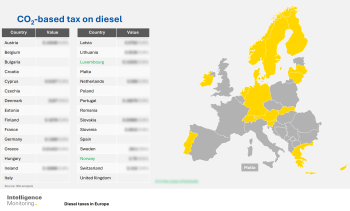

Diesel VAT rates range from 8.1% to 27% in Europe – and 17 European countries apply a CO₂-based component to their diesel tax. Our latest Intelligence Monitoring details the various taxes applied to diesel by country.

IRU’s new Intelligence Monitoring helps readers better understand fuel price dynamics by assessing the final cost faced by transport operators.

It provides information on national VAT rates, excise duties, CO₂ taxes, and other indirect taxes.

While transport operators can often recover VAT, both nationally and internationally, indirect taxes must be paid in full (some governments offer partial refunds to national fleets). The monitoring complements the IRU Intelligence Briefing on fuel prices.

Access Intelligence Monitoring

IRU members and strategic partners have full access to all IRU Intelligence services and publications.

Don’t have access? Subscribe to IRU Intelligence.

Optimise your operations and make informed, future-oriented decisions with IRU intelligence.