A lot has happened this year. We explored the key issues and initiatives that impacted cross-border trucking in North America in 2025 – and what to expect in 2026 – during our end-of-year webinar.

Following the 2024 US election, 2025 has witnessed significant developments in policy, regulatory and trade spheres, prompting a reassessment of their impact on cross-border trucking in North America.

One key aspect is the United States–Mexico–Canada Agreement (also known as CUSMA and USMCA, hereafter referred to as the Agreement), originally negotiated in 2018. Six years after its implementation, a review process is taking place to address updates and industry needs.

Our expert speakers – Bob Costello (Chief Economist and Senior Vice President International Trade & Security Policy, American Trucking Associations – ATA), Lak Shoan (Director of Policy and Industry Awareness Programs, Canadian Trucking Alliance – CTA) and Manuel Sotelo (Vice President for the Northern Region, Camara Nacional del Autotransporte de Carga – CANACAR) – detailed the key developments from 2025 as we gear up for 2026.

Drinking out of a fire hose

Bob Costello kicked off the webinar with the US perspective.

“Since January, we’ve been drinking out of a fire hose. A lot of policy changes have impacted trade via trucks.

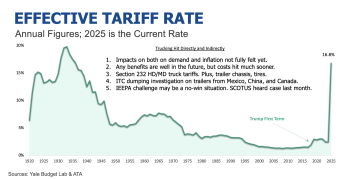

“Tariffs have been put on a lot of goods. The effective tariff rate in the US is now just shy of 17%, a level we have not seen since the 1930s. We have not yet seen the full effect of this.

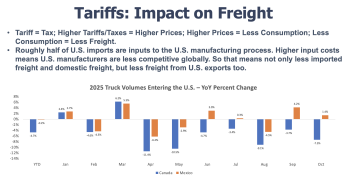

“Looking at truck entry into the US. Canada is down quite a bit year to date, just shy of 5%, but even Mexico is down. We'll call it flat. Even if it's flat, that is significant. The growth from Mexico has been tremendous over the last few years and beyond, so the fact that it is flat and not growing is really telling.”

Bob Costello also touched on the impact of tariffs on trucks.

“Effective 1 November, the administration announced that there will be a 25% tariff on non-US content of trucks coming from Mexico. In terms of heavy-duty trucks, that’s essentially the only source for imports.

“We estimate that this 25% tariff will apply to about 50% [of the content] of trucks coming in. One manufacturer has already stated that this represents nearly a USD 10,000 increase per truck, so it will have a significant impact.”

Bob Costello also discussed the Agreement, the non-domicile CDL interim final rule, English language proficiency changes, cabotage updates, B-1 visa drivers, and more.

A challenging year

Lak Shoan examined several cross-border issues that affected Canadian fleets in 2025.

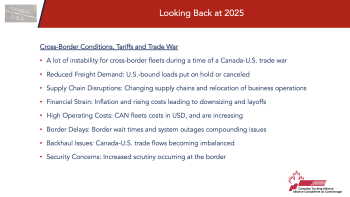

“The ongoing US trade war, including tariffs on Canadian goods such as steel and aluminium, along with retaliatory measures, has created significant volatility. Several compounding factors, including reduced freight demand, have added to the uncertainty.

“Some carriers have reported loads being cancelled or put on hold. Many predict that this reduced demand will continue through a significant portion of 2026.”

In terms of supply chain disruptions, Lak Shoan highlighted that customers are experiencing higher costs and are being forced to alter their sourcing strategies, with some relocating, or considering relocating, their operations to the US. This trend is already visible in the auto sector in Ontario, as well as in the agriculture and forestry sectors.

“Canadian trucking companies continue to face financial strain due to rising costs across multiple areas,” said Lak Shoan. “Combined with declining revenues, this is forcing some fleets to downsize or lay off employees.”

“Higher operating costs are exacerbated because Canadian fleets often pay for fuel and equipment in US dollars, which continues to erode profit margins,” he added.

Border delays and wait times at the northern border also remain a major challenge for Canadian fleets, causing delivery delays and reducing supply chain reliability.

Imbalanced trade flows have created backhaul issues, with many trucks returning to Canada with lighter or empty loads.

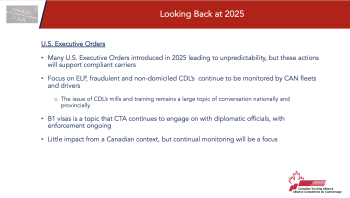

Finally, the theme of change and unpredictability has been reinforced by various US executive orders introduced in 2025. Although not directly targeting Canadian carriers or drivers, those moving freight internationally must adapt and comply with these evolving regulatory environments.

Lak Shoan also discussed B1 visas, border security, the review of the Agreement, emerging technologies, and more.

In limbo

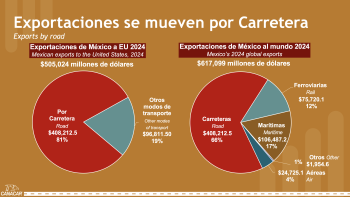

Manuel Sotelo, who is also a carrier, highlighted the critical role of trucking in North American trade and touched on a few key points affecting cross-border trucking.

“We need to automate border-crossing facilities and invest in infrastructure,” said Manuel Sotelo. “Otherwise, the industry will lose competitiveness.”

Regarding the Agreement, Manuel Sotelo said, “Whether the Agreement is extended or not will affect investment decisions in logistics, as well as in transport and fleet renewal. If there is no certainty, and we must wait until next year to know whether the treaty will continue or end, many investors may hesitate.”

“The main risks we see include protectionist measures from the US, administrative barriers, tighter rules of origin affecting Mexican supply chains, rising operational costs without incentives for carriers (at least in our country), and legal uncertainty that could hinder sector investment,” he added.

Manuel Sotelo then discussed some of the opportunities facing the sector.

“Last year, we discussed nearshoring, and there was optimism because many investments were expected to land in Mexico. However, political changes in Mexico and shifts in the US have caused delays.

“Despite this, opportunities remain, and we need all three countries to work together to modernise regulations in a way that triggers investment in fleet technology and safety, raising overall industry standards.”

Mexico’s geographic position gives it the potential to become North America’s logistics hub, if long border queues are eliminated and sufficient personnel are deployed on both the Mexican and US sides (and presumably in Canada as well). Achieving this would enhance competitiveness and allow Mexico to compete globally in terms of service and efficiency.

Manuel Sotelo also shared proposals for the Agreement.

“Our agenda should aim to strengthen transport, the backbone of trade in our region. Naturally, if transport performs well, the Agreement also benefits. And if the Agreement is strengthened, all of Mexico prospers,” concluded Manuel Sotelo.

The full webinar replay is available here.

This webinar was organised by the IRU North American Transportation Forum (NATF).

Together with IRU member ATA, CANACAR and CTA, NATF brings together senior management from leading carriers, shippers and logistics companies in the sector.

Click here to be notified of future NATF webinars and events.